Essay

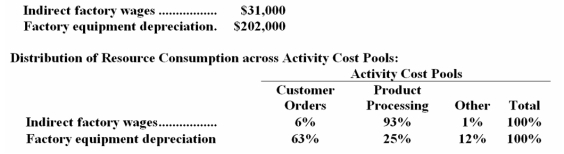

Ternasky Corporation has provided the following data from its activity-based costing accounting system:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

Required:

a.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool.Show your work!

b.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products.Show your work!

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The Other activity cost pool is used

Q6: An action analysis report reconciles activity-based costing

Q9: Accola Company uses activity-based costing. The

Q9: Setting up equipment is an example of

Q12: The Other activity cost pool is used

Q13: The Other activity cost pool is used

Q15: Lifsey Wedding Fantasy Company makes very elaborate

Q33: The following data have been provided by

Q34: Lippincott Corporation uses an activity-based costing system

Q75: Dilloo Company uses an activity-based costing system