Essay

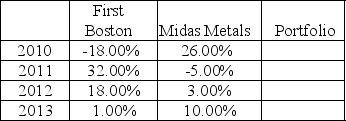

Returns on the stock of First Boston and Midas Metals for the years 2010-2013 are shown below.

a.Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

b.Compute the standard deviation for each stock and the portfolio.

c.Are the stocks positively or negatively correlated and what is the effect on risk?

Correct Answer:

Verified

c.The two stocks are negatively correla...

c.The two stocks are negatively correla...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: A stock's beta value is a measure

Q26: Which of the following will always lower

Q27: Which one of the following will provide

Q28: The stock of a technology company has

Q29: Systematic risks<br>A)can be eliminated by investing in

Q33: Large, professionally managed portfolios tend to<br>A)lie on

Q33: Betas for actively traded stocks. are readily

Q34: Which of the following statements about the

Q55: Correlation is a measure of the relationship

Q57: The basic theory linking portfolio risk and