Multiple Choice

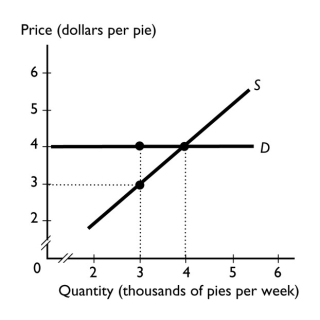

-The demand for apple pies is perfectly elastic.If the government taxes apple pies at $1 a pie,then ________.

A) the seller pays the entire tax

B) the buyer pays the entire tax

C) the seller and the buyer split the tax evenly

D) the seller and the buyer split the tax but the seller pays more

E) who pays the tax depends on whether the government imposes the tax on pie buyers or on pie sellers

Correct Answer:

Verified

Correct Answer:

Verified

Q95: If taxes are collected on the basis

Q96: The argument that those who use the

Q97: The buyer will pay the entire tax

Q98: The supply of sand is perfectly inelastic

Q99: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1458/.jpg" alt=" -The above figure

Q101: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1458/.jpg" alt=" -The figure above

Q102: Cigarettes are highly addictive and therefore have

Q103: The assertion that Bill Gates and Paris

Q104: The ability-to-pay principle of tax fairness is

Q105: The average tax rate is the<br>A) percentage