Multiple Choice

Refer to the information provided in Scenario 10.1 below to answer the questions that follow.

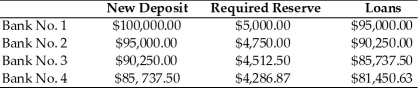

SCENARIO 10.1: The following table shows the changes in deposits, reserves, and loans of 4 banks as a result of a $100,000 initial deposit in Bank No. 1. Assume all banks are loaned up.

-Refer to Scenario 10.1. What is the required reserve ratio?

A) 4%

B) 5%

C) 8%

D) 10%

Correct Answer:

Verified

Correct Answer:

Verified

Q123: A commercial bank lists<br>A) loans as liabilities.<br>B)

Q124: When the value of money falls as

Q125: The Fed became an active participant in

Q126: The federal funds rate is the rate

Q127: The tool most frequently used by the

Q129: Which of the following types of interest

Q130: Nominal income is equal to<br>A) the aggregate

Q131: When the prices of goods and services

Q132: Which of the following represents an action

Q133: Transaction money is<br>A) M1.<br>B) M2.<br>C) M3.<br>D) M4.