Multiple Choice

Refer to the information provided in Scenario 10.1 below to answer the questions that follow.

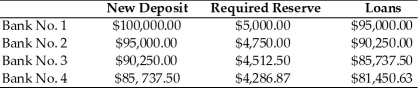

SCENARIO 10.1: The following table shows the changes in deposits, reserves, and loans of 4 banks as a result of a $100,000 initial deposit in Bank No. 1. Assume all banks are loaned up.

-Refer to the Economics in Practice on p. 193: The Economics in Practice feature discusses three examples of many people who have claims on a bank presenting those claims at the same time. This describes a situation known as

A) barter.

B) a bank run.

C) currency debasement.

D) the liquidity property of money.

Correct Answer:

Verified

Correct Answer:

Verified

Q261: Any transaction that involves exchanging one good

Q262: Which of the following is included in

Q263: The Fed is a nonprofit institution whose

Q264: Banks can hold required reserves either as

Q265: The Fed uses open market operations to<br>A)

Q267: Napoli National Bank has liabilities of $3

Q268: The federal funds rate is the interest

Q269: Near monies are close substitutes for<br>A) fiat

Q270: Things that a firm owns that are

Q271: If the Fed sells government securities, then