Multiple Choice

4.2 Supply and Demand Analysis: An Oil Import Fee

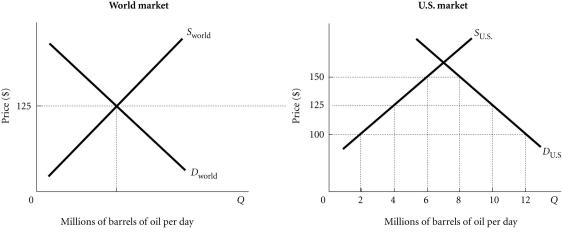

Refer to the information provided in Figure 4.4 below to answer the questions that follow.  Figure 4.4

Figure 4.4

-Refer to Figure 4.4. Assume that initially there is free trade. If the United States then imposes a $25 tax per barrel of imported oil,

A) the quantity of oil demanded will be reduced by 4 million barrels per day.

B) the quantity of oil supplied by U.S. firms will increase by 8 million barrels per day.

C) U.S. imports of oil will increase by 4 million barrels per day.

D) the price of oil in the U.S. will increase to $150 per barrel.

Correct Answer:

Verified

Correct Answer:

Verified

Q53: A price ceiling is<br>A) a minimum price

Q84: Refer to the information provided in Figure

Q86: Producer surplus is<br>A) the difference between the

Q89: On a graph, consumer surplus is the

Q120: The type of nonprice rationing that most

Q126: Related to the Economics in Practice on

Q127: People scalping tickets for a jazz festival

Q138: Producer surplus describes a situation in which

Q143: Goods are allocated in a market system

Q158: Refer to the information provided in Figure