Multiple Choice

In May 2017, a parent entity sold inventories to a subsidiary entity for $30 000. The inventories had previously cost the parent entity $24 000. The entire inventories are still held by the subsidiary at reporting date, 30 June 2017. Ignoring tax effects, the adjustment entry in the consolidation worksheet at reporting date is:

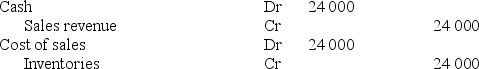

A)

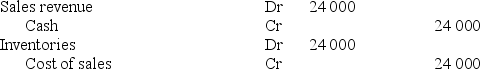

B)

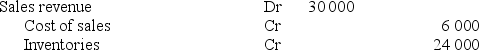

C)

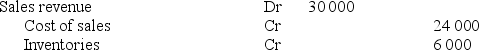

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q8: A parent entity group sold a depreciable

Q9: During the current period, a subsidiary entity

Q10: Jameson purchased goods from its subsidiary for

Q11: Which of the following statements is incorrect:<br>A)

Q12: The changes in accounting standards since year

Q14: During the year ended 30 June 2017,

Q15: Winter Limited paid during the period an

Q16: Janus Limited, a subsidiary entity, sold during

Q17: Andronico Limited provided an advance of $500

Q18: Which of the following questions is not