Multiple Choice

During the year ended 30 June 2017, a subsidiary entity sold inventories to a parent entity for $30 000. The inventories had previously cost the subsidiary entity $24 000. By 30 June 2017 the parent entity had sold all the inventories to a party outside the group. The company tax rate is 30%. The adjustment entry in the consolidation worksheet at 30 June 2018 is:

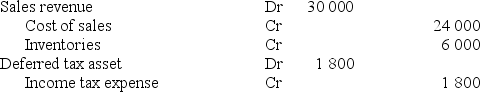

A)

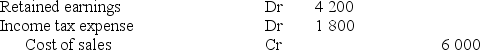

B)

C) No entry is required

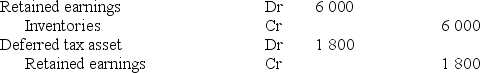

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: When a subsidiary declares a final dividend

Q30: A subsidiary sold inventories to its parent

Q31: The consolidation adjustments in relation to intragroup

Q32: Which of the following statements is incorrect:<br>A)

Q33: On 1 July 2016, a parent entity

Q34: A Ltd sold an item of plant

Q35: AASB 10 Consolidated Financial Statements, requires that

Q36: A Ltd sold an item of plant

Q39: A Ltd sold an item of plant

Q40: During the current period, Angelo Limited sold