Multiple Choice

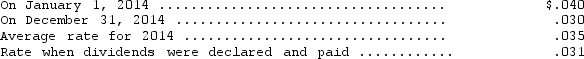

Pilsner Company.converts its foreign subsidiary financial statements using the translation process.The company's subsidiary in the Czech Republic reported the following for 2014: revenues and expenses of 25,000,000 and 18,500,000 koruna,respectively,earned or incurred evenly throughout the year,dividends of 1,500,000 koruna were paid during the year.The following exchange rates are available:  Translated net income for 2014 is

Translated net income for 2014 is

A) $148,500.

B) $227,500.

C) $175,000.

D) $195,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: On July 15,2014,American Manufacturing Inc. ,a Los

Q29: Current generally accepted accounting principles require that

Q30: Which of the following is NOT a

Q31: Foreign currency translation adjustments arising from translation

Q32: Which of the following statements regarding international

Q34: Under international accounting standards,remote contingent liabilities are

Q35: The following financial information is available for

Q36: The SEC currently requires foreign companies that

Q37: Under international accounting standards,cash paid for dividends

Q38: Windsor Enterprises,a subsidiary of Kennedy Company based