Multiple Choice

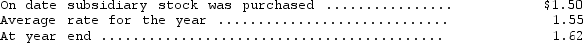

Florence Enterprises,a subsidiary of Verona Company based in New York,reported the following information at the end of its first year of operations (all in euros) : assets--1,320,000;expenses--340,000;liabilities--880,000;capital stock--80,000,revenues--400,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

A) $25,200 debit adjustment

B) $34,800 debit adjustment

C) $34,800 credit adjustment

D) $25,200 credit adjustment

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The foreign currency translation adjustments amount is

Q6: A translation adjustment resulting from the translation

Q7: Under international accounting standards,the standard for accounting

Q8: According to FASB ASC Topic 830 (Foreign

Q9: The primary purpose of the Security and

Q11: Under international accounting standards,cash paid for interest

Q12: Monty Enterprises,a subsidiary of Kerry Company based

Q13: Under international accounting standards,the derecognition of receivables

Q14: Financial information for Pinnacle Enterprises at the

Q15: Under international accounting standards,cash paid for income