Multiple Choice

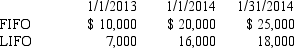

A retailing firm changed from LIFO to FIFO in 2014.Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

Purchases in 2013 and 2014 were $60,000 in each year.

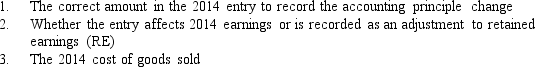

-Using the information above,choose the following:

A) $4,000 RE $55,000

B) $7,000 RE $58,000

C) $4,000 Earnings $55,000

D) $7,000 Earnings $58,000

Correct Answer:

Verified

Correct Answer:

Verified

Q39: In 2014,a company changed from the LIFO

Q40: Asuncion Company purchased some equipment on January

Q41: In 2014,a company discovered that $20,000 of

Q42: Baron Co.began operations on January 1,2011,at which

Q43: At the time Hollywood Corporation became a

Q45: On January 1,2011,Mardi Gras Shipping bought a

Q46: Ideally,managers should make accounting changes only as

Q47: Crafter,Inc.receives subscription payments for annual (one year)subscriptions

Q48: Songtress Company bought a machine on January

Q49: Basilia Corporation purchased a machine for $180,000