Multiple Choice

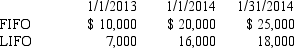

A retailing firm changed from LIFO to FIFO in 2014.Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

Purchases in 2013 and 2014 were $60,000 in each year.

-Using the information above,in the comparative 2013 and 2014 income statements,what amounts would be shown for cost of goods sold? 2013 2014

A) $50,000 $58,000

B) $51,000 $55,000

C) $50,000 $55,000

D) $51,000 $58,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following is NOT correct

Q2: Which of the following is the proper

Q3: Mako's Distributing purchased equipment on January 1,2011.The

Q4: Rickles,Inc.is a calendar-year corporation whose financial statements

Q6: McCartney Corp.reports on a calendar-year basis.Its 2013

Q7: If,at the end of a period,Michaels Company

Q8: Which of the following does NOT represent

Q9: Strong Company's December 31 year-end financial statements

Q10: A company mistakenly expensed a $100,000 machine

Q11: An example of an item that should