Multiple Choice

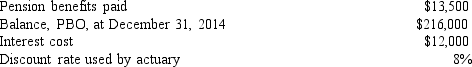

Jenine Company sponsors a noncontributory,defined benefit pension plan.On December 31,2014,the end of the company's accounting period,the company received the projected benefit obligation report from the independent actuary.The following data were included:  Based on this information,the January 1,2014,balance for the PBO and the service cost for the year ended December 31,2014,were

Based on this information,the January 1,2014,balance for the PBO and the service cost for the year ended December 31,2014,were

Beginning PBO 2014 Service Cost

A) $150,000 $81,000

B) $150,000 $67,500

C) $216,000 $67,500

D) $163,500 $54,000

Correct Answer:

Verified

Correct Answer:

Verified

Q27: One component of net pension expense,unrecognized gains

Q28: Blue Ice Inc.compensates its employees for certain

Q29: Based on the following data,determine the net

Q30: International accounting standards for pensions currently in

Q31: During the first week of February,Gabe Hopen

Q33: Which of the following taxes must be

Q34: The following balances relate to the defined

Q35: Which of the following payroll taxes are

Q36: Paltry Corporation has a pension plan that

Q37: The following information relates to the defined