Essay

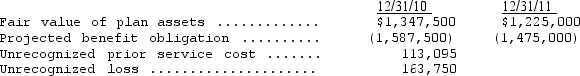

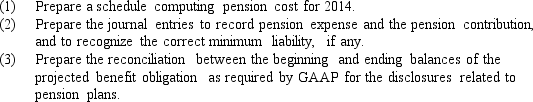

Feinberg,Inc. ,provides a noncontributory defined benefit plan for its 200 employees.Information from the company's pension footnote for the year ended December 31,2013,and partial information for the year ended December 31,2014,are given below:

The company's actuary indicated that the settlement rate and expected rate of return on plan assets were both 8% for 2013 and 2014.The company contributed $221,250 to the plan at the end of 2014.Service cost for 2014 was $125,000.

The company's actuary indicated that the settlement rate and expected rate of return on plan assets were both 8% for 2013 and 2014.The company contributed $221,250 to the plan at the end of 2014.Service cost for 2014 was $125,000.

On January 1,2013,the company amended its plan to grant retroactive credit for prior service rendered by employees prior to the amendment.This amendment increased unrecognized prior service cost by $125,000 at that date.The prior service cost is being amortized over the average remaining service life of the employees affected by the amendment.The average remaining service life of the workforce in each year has been constant at 10.5 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following is not an

Q3: Total pension expense recognized over the life

Q4: Which of the following statements is correct?<br>A)

Q5: During the first week of February,Gabe Hopen

Q6: Which of the following is not a

Q8: Using the information below,compute the gain or

Q9: The following information relates to the defined

Q10: On January 1,2014,Bongle Co.amended its defined benefit

Q11: Evasive Corporation pays its employees monthly.The following

Q12: Which of the following is not a