Multiple Choice

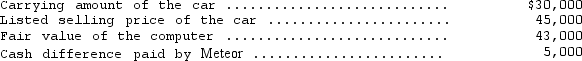

Meteor Motor Sales exchanged a car from its inventory for a computer to be used as a noncurrent operating asset.The following information relates to this exchange that took place on July 31,2014:  The exchange has commercial substance.

The exchange has commercial substance.

On July 31,2014,how much profit should Meteor recognize on this exchange?

A) $0

B) $8,000

C) $10,000

D) $13,000

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Image Creators,Inc.owns the following equipment and computes

Q33: In 2013,Pauley Company paid $1,000,000 to purchase

Q34: Information concerning Santori Corporation's intangible assets is

Q35: Five years ago,Monroe,Inc. ,purchased a patent for

Q36: On January 1,2012,Costas Co.purchased a new machine

Q38: In accordance with generally accepted accounting principles,which

Q39: Backhoe Construction Company recently exchanged an old

Q40: Which of the following assets generally is

Q41: On January 1,2010,Elaine Company purchased for $600,000,a

Q42: Which of the following depreciation methods is