Essay

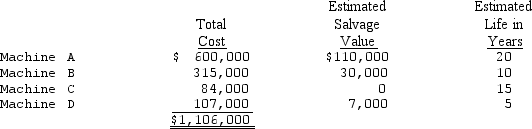

The following is a schedule of machinery owned by Stanton Manufacturing Company.

Stanton computes depreciation on the straight-line basis.Based on the information presented,compute the:

Stanton computes depreciation on the straight-line basis.Based on the information presented,compute the:

Correct Answer:

Verified

Correct Answer:

Verified

Q41: On January 1,2010,Elaine Company purchased for $600,000,a

Q42: Which of the following depreciation methods is

Q43: Nielsen Cargo Company recently exchanged an old

Q44: In October 2014,Pollock Company exchanged a used

Q45: Ibarra Carpet traded cleaning equipment with a

Q47: The composite depreciation method<br>A) is applied to

Q48: In 2013,Bootcamp Mining Inc.purchased land for $5,600,000

Q49: Mantle Company exchanged a used autograph-signing machine

Q50: In January 2014,Bevis Company exchanged an old

Q51: On July 1,Toucan Corporation,a calendar-year company,received a