Essay

Irvington Manufacturing Inc.purchased a new machine on January 2,2014,that was built to perform one function on its assembly line.Data pertaining to this machine are:

Acquisition cost $330,000

Residual value $30,000

Estimated service life:

Years 5

Service hours 250,000

Production output 300,000

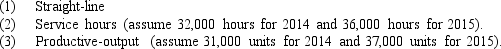

Using each of the following methods,compute the annual depreciation rate and charge for the years ended December 31,2014,and 2015:

Correct Answer:

Verified

Correct Answer:

Verified

Q66: Depreciation is the systematic allocation of historical

Q67: Hyde Company traded in an old machine

Q68: Information needed to compute a depletion charge

Q69: Which of the following utilizes the straight-line

Q70: Underwood Company purchased a machine on January

Q72: On June 30,2014,a fire in Walnut Company's

Q73: Which of the following depreciation methods applies

Q74: Pepitone Inc.exchanged a machine costing $400,000 with

Q75: During 2009,Cabot Machine Company spent $352,000 on

Q76: A truck that cost $12,000 was originally