Essay

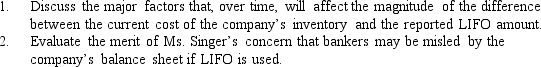

Management of the Singer Company is currently considering the possibility of changing from the FIFO method to the LIFO method of inventory valuation for income tax and financial reporting purposes.The company's president,Diane Singer,is concerned that using LIFO will tend to distort the company's balance sheet over time.She believes that the difference between the current cost of the company's inventory and the reported LIFO valuation will tend to grow larger each year,and that the company's reported LIFO inventory valuation will be progressively understated in relation to current cost.Singer Company relies heavily on short-term bank credit,and Ms.Singer feels that the company's bankers will tend to downgrade the company's short-term debt-paying ability if a switch to LIFO is made.

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Q70: Which of the following inventory costing methods

Q71: A company records inventory at the gross

Q72: Purchases and sales during a recent period

Q73: Paper Depot is a wholesaler of office

Q74: The following information is available for the

Q76: A company sells four products: I,II,III,and IV.The

Q77: When using the periodic inventory method,which of

Q78: A firm using the perpetual inventory method

Q79: The data below relate to Raw Material

Q80: Salvage Company reported the following net income