Essay

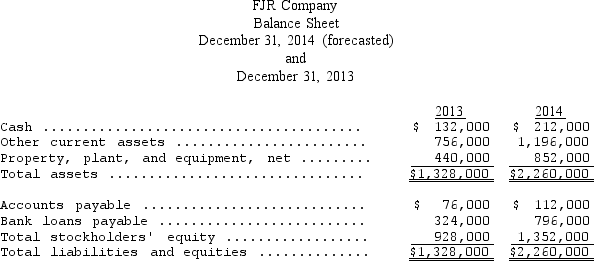

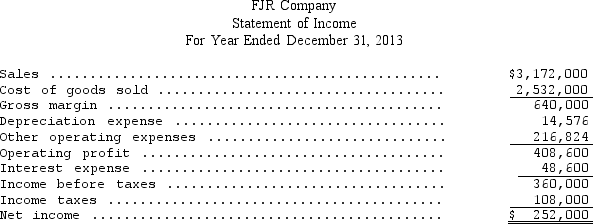

FJR Company is preparing a forecast of its net income for the year 2014.In addition,FJR plans to construct a forecasted statement of cash flows for 2014.The balance sheet and income statement data for 2013 are presented below,as well as a forecast of the balance sheet for 2014.Management expects sales in 2014 to rise to $6,000,000.In order to achieve this level of increase,management estimates that operating expenses (specifically sales commissions)will rise to $410,134.

Prepare a forecasted income statement and forecasted statement of cash flows (using the indirect method)for the year ended December 31,2014,for FJR Company.Calculate the cash flow to net income and cash flow adequacy ratios.There were no changes in stockholders' equity other than net income and cash dividends.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: In preparing a statement of cash flows,which

Q36: In a statement of cash flows,if equipment

Q37: Cash flows from investing activities would be

Q38: Which of the following is not a

Q39: During 2014,Stewart Company reported revenues on an

Q41: Noncash investing and financing activities,if material,are<br>A) reported

Q42: A decrease in accounts receivable should be

Q43: Dingo Boot Company uses the direct method

Q44: Stanner Company's 2014 income statement reported cost

Q45: The following information was taken from the