Multiple Choice

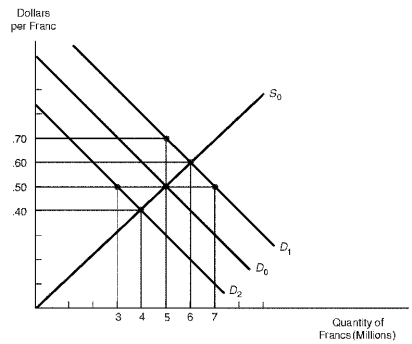

Figure 15.1 shows the market for the Swiss franc. In the figure, the initial demand for marks and supply of marks are depicted by D? and S? respectively.

Figure 15.1. The Market for the Swiss Franc

-Refer to Figure 15.1.Suppose the demand for francs increases from D? to D?.Under a fixed exchange rate system,the U.S.exchange stabilization fund could maintain a fixed exchange rate of $0.50 per franc by:

A) Selling francs for dollars on the foreign exchange market

B) Selling dollars for francs on the foreign exchange market

C) Decreasing U.S. exports, thus decreasing the supply of francs

D) Stimulating U.S. imports, thus increasing the demand for francs

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Pegging to a single currency is generally

Q56: The Australian dollar is currently regarded is

Q91: To keep the pound's exchange value from

Q98: A surplus nation can reduce its payments

Q99: What is the difference between the crawling

Q105: To offset an appreciation in the dollar's

Q119: Under a floating exchange rate system,if there

Q128: Which exchange-rate mechanism calls for frequent redefining

Q158: In order to stabilize a currency,the central

Q167: In 1973 the major industrial countries terminated