Multiple Choice

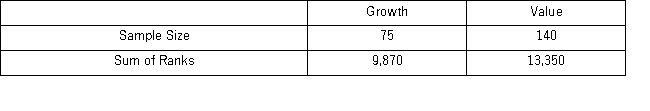

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) .The fund manager collects data on the returns of growth and value funds.Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Using the critical value approach and α = 0.01,the appropriate conclusion is ____________.

Using the critical value approach and α = 0.01,the appropriate conclusion is ____________.

A) reject the null hypothesis;conclude the median return of growth stock is greater than the median return of value stocks

B) do not reject the null hypothesis;conclude the median return of value stock is greater than the median return of growth stocks

C) do not reject the null hypothesis;conclude the median return of growth stock differs from the median return of value stocks

D) reject the null hypothesis;we cannot conclude the median return of growth stocks is greater than the median return of value stocks

Correct Answer:

Verified

Correct Answer:

Verified

Q1: An energy analyst wants to test if

Q24: An accountant wants to know if the

Q30: A trading magazine wants to determine the

Q31: Pearson's correlation coefficient is used as the

Q33: Which of the following is the sample

Q34: An energy analyst wants to test if

Q45: A trading magazine wants to determine the

Q54: The Kruskal-Wallis test is always a _-tailed

Q82: For the Spearman rank correlation test we

Q105: An energy analyst wants to test if