Multiple Choice

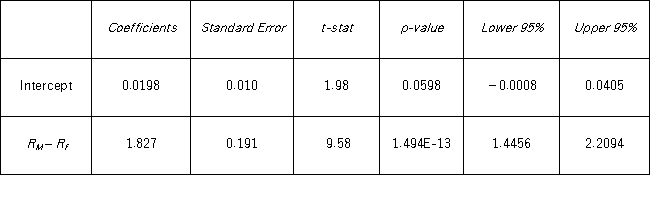

Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the capital asset pricing model (CAPM) model for Tiffany's return.  You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses: __________________.

You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses: __________________.

A) H0:α = 0;HA:α ≠ 0

B) H0:β = 0;HA:β ≠ 0

C) H0:α ≤ 1;HA:α >0

D) H0:β ≤ 1;HA:β >1

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Multicollinearity is suspected when _.<br>A) there is

Q10: Conditional on x<sub>1</sub>, x<sub>2</sub>, ..., x<sub>k</sub>, the

Q41: _ plots can be used to detect

Q72: A manager at a local bank analyzed

Q73: Given the following portion of regression results,which

Q74: A marketing analyst wants to examine the

Q76: When testing r linear restrictions imposed on

Q77: A wavelike movement in residuals suggests positive

Q78: A researcher analyzes the factors that may

Q79: A researcher analyzes the factors that may