Essay

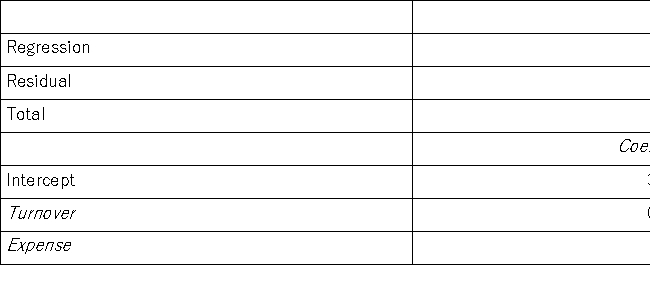

An investment analyst wants to examine the relationship between a mutual fund's return,its turnover rate,and its expense ratio.She randomly selects 10 mutual funds and estimates:  ,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and is the random error component.A portion of the regression results is shown in the accompanying table.

,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and is the random error component.A portion of the regression results is shown in the accompanying table.  a.Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

a.Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

b.Interpret the slope coefficient attached to Expense.

c.Calculate the standard error of the estimate.If the sample mean for Return is 34.7%,what can you infer about the model's predictive power.

d.Calculate and interpret the coefficient of determination.

Correct Answer:

Verified

The regression equation is  .Use given c...

.Use given c...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: The standard error of the estimate measures

Q62: Costco sells paperback books in their retail

Q64: Consider the following information regarding a response

Q65: Over the past 30 years,the sample standard

Q68: The coefficient of determination R<sup>2</sup> is _.<br>A)

Q69: Which of the following Excel's functions return

Q70: Each point in the scatterplot represents one

Q71: A sample of 30 observations provides the

Q91: The relationship between the response variable and

Q129: Consider the following simple linear regression model: