Multiple Choice

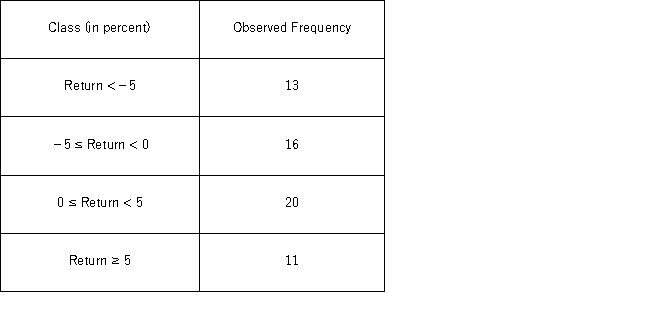

The following frequency distribution shows the monthly stock returns for Home Depot for the years 2003 through 2007.  Over the time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.At the 5% confidence level,which of the following is the correct conclusion for this goodness-of-fit test for normality?

Over the time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.At the 5% confidence level,which of the following is the correct conclusion for this goodness-of-fit test for normality?

A) Reject the null hypothesis;conclude that monthly stock returnsare normally distributed with mean 0.31% and standard deviation 6.49%.

B) Reject the null hypothesis;conclude that monthly stock returnsare not normally distributed with mean 0.31% and standard deviation 6.49%.

C) Do not reject the null hypothesis;conclude that monthly stock returnsare normally distributedwith mean 0.31% and standard deviation 6.49%

D) Do not reject the null hypothesis;conclude that monthly stock returnsare not normally distributed with mean 0.31% and standard deviation 6.49%.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: For the goodness-of-fit test, the chi-square test

Q13: For a chi-square goodness-of-fit test,the expected category

Q15: The following table shows numerical summaries of

Q16: For a chi-square test of a contingency

Q18: For the goodness-of-fit test,the expected category frequencies

Q20: A manufacturer of flash drives for data

Q21: The following table shows the distribution of

Q22: In the following table,likely voters' preferences of

Q74: Suppose you want to determine if gender

Q116: What are the degrees of freedom for