Multiple Choice

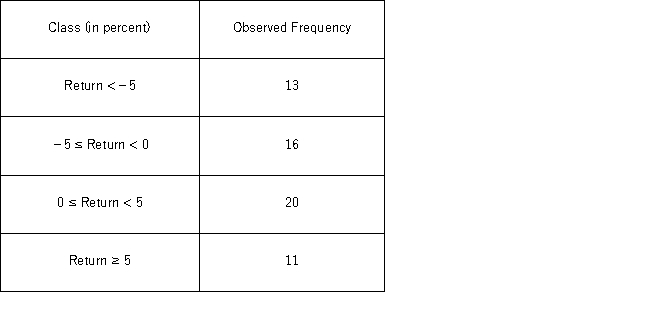

The following frequency distribution shows the monthly stock returns for Home Depot for the years 2003 through 2007.  Over time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.At the 5% confidence level,which of the following is the correct conclusion for the Jarque-Bera test for normality?

Over time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.At the 5% confidence level,which of the following is the correct conclusion for the Jarque-Bera test for normality?

A) Reject the null hypothesis;conclude that monthly stock returnsare normally distributed with mean 0.31% and standard deviation 6.49%.

B) Reject the null hypothesis;conclude that monthly stock returnsare not normally distributed with mean 0.31% and standard deviation 6.49%.

C) Do not reject the null hypothesis;conclude that monthly stock returnsare normally distributed with mean 0.31% and standard deviation 6.49%

D) Do not reject the null hypothesis;conclude that monthly stock returnsare not normally distributed with mean 0.31% and standard deviation 6.49%.

Correct Answer:

Verified

Correct Answer:

Verified

Q48: A travel agent wants to determine if

Q103: For the chi-square test of a contingency

Q104: In the following table,likely voters' preferences of

Q105: A university has six colleges and takes

Q106: The airline industry defines "no-shows" as passengers

Q107: A card-dealing machine deals spades (1),hearts (2),clubs

Q109: Suppose Bank of America would like to

Q110: A fund manager wants to know if

Q111: In the following table,individuals are cross-classified by

Q113: The airline industry defines "no-shows" as passengers