Multiple Choice

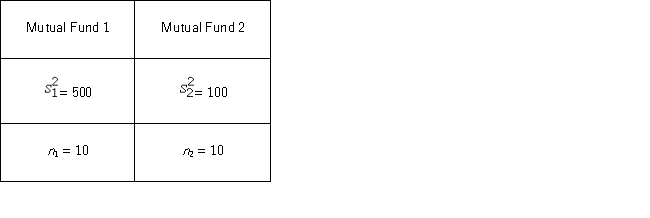

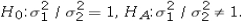

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  The competing hypotheses are

The competing hypotheses are  At α = 0.10,is the analyst's claim supported by the data?

At α = 0.10,is the analyst's claim supported by the data?

A) No,the p-value < α = 0.10.

B) Yes,the p-value > α = 0.10.

C) No,the p-value > α = 0.10.

D) Yes,the p-value < α = 0.10.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The value of the test statistic to

Q5: Construct a 95% confidence interval for the

Q6: The manager of a video library would

Q7: The value of the test statistic for

Q8: Amie Jackson,a manager at Sigma travel services,makes

Q9: Becky owns a diner and is concerned

Q10: A financial analyst examines the performance of

Q35: The following data, drawn from a normal

Q44: Becky owns a diner and is concerned

Q55: Consider the hypotheses H<sub>0</sub>: σ<sup>2</sup> = 169,