Multiple Choice

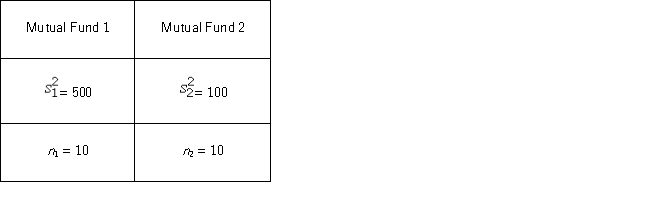

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Use the following summary statistics.  The competing hypotheses are

The competing hypotheses are  At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

A) No,because the value of the test statistic is less than the critical F value.

B) Yes,because the value of the test statistic is less than the critical F value.

C) Yes,because the value of the test statistic is greater than the critical F value.

D) No,because the value of the test statistic is greater than the critical F value.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following is a 98%

Q30: The supervisor of an automobile sales and

Q56: The following are the measures based on

Q57: The <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="The distribution

Q58: Consider the expected returns (in percent)from the

Q59: The following table shows the heights (in

Q61: Edmunds.com would like to test the hypothesis

Q63: The following are the competing hypotheses and

Q64: Which of the following are the degrees

Q65: If s<sup>2</sup> is computed from a random