Multiple Choice

A financial analyst maintains that the risk,measured by the variance,of investing in emerging markets is more than 280(%) 2.Data on 20 stocks from emerging markets revealed the following sample results:  = 12.1% and s2 = 361(%) 2.Assume that the returns are normally distributed.Which of the following are appropriate hypotheses to test the analyst's claim?

= 12.1% and s2 = 361(%) 2.Assume that the returns are normally distributed.Which of the following are appropriate hypotheses to test the analyst's claim?

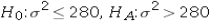

A)

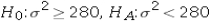

B)

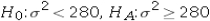

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The formula for the confidence interval of

Q3: A random sample of 18 observations is

Q8: Amie Jackson,a manager at Sigma travel services,makes

Q9: Becky owns a diner and is concerned

Q10: A financial analyst examines the performance of

Q12: Edmunds.com would like to test the hypothesis

Q14: The sampling distribution of <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="The

Q15: For a sample of 10 observations drawn

Q17: The sample standard deviation of the monthly

Q55: Consider the hypotheses H<sub>0</sub>: σ<sup>2</sup> = 169,