Multiple Choice

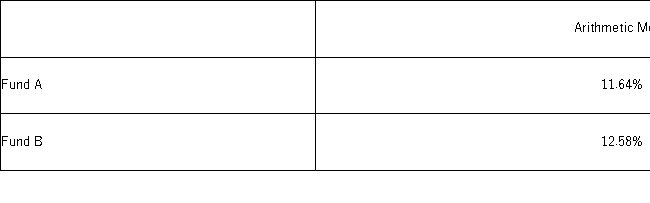

The following table summarizes selected statistics for two portfolios for a 10-year period ending in 2006.Assume that the risk-free rate is 4% over this period.  As measured by the Sharpe ratio,the fund with the superior risk-adjusted performance during this period is _________________________________________________________.

As measured by the Sharpe ratio,the fund with the superior risk-adjusted performance during this period is _________________________________________________________.

A) Fund A because it has a lower positive Sharpe ratio than Fund B

B) Fund B because it has a lower positive Sharpe ratio than Fund A

C) Fund A because it has a higher positive Sharpe ratio than Fund B

D) Fund B because it has a higher positive Sharpe ratio than Fund A

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Amounts spent by a sample of 200

Q57: The following data represent the wait time,in

Q58: An investor bought common stock of Blackstone

Q59: The following gives summary measures for Google

Q60: Consider a population with data values of

Q61: The following is data a veterinarian collected

Q99: When applicable, the empirical rule provides the

Q117: Which of the following statements is most

Q124: The variance is an average squared deviation

Q147: The range is defined as _.<br>A) Q3