Multiple Choice

Exhibit 20-1

Assume a U.S.-based MNC is borrowing Romanian leu (ROL) at an interest rate of 8% for one year. Also assume that the spot rate of the leu is $.00012 and the one-year forward rate of the leu is $.00010. The expected spot rate of the leu one-year from now is $.00011.

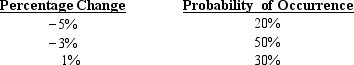

-Maston Corporation has forecasted the value of the Russian ruble as follows for the next year:  If the Russian interest rate is 30%, the expected cost of financing a one-year loan in rubles is:

If the Russian interest rate is 30%, the expected cost of financing a one-year loan in rubles is:

A) 27.14%.

B) 32.86%.

C) 26.10%.

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A firm without any exposure to foreign

Q21: Euronotes are unsecured debt securities whose interest

Q37: Exhibit 20-1<br>Assume a U.S.-based MNC is borrowing

Q38: The degree of volatility of financing with

Q40: MNCs may be able to lock in

Q41: The effective financing rate:<br>A) adjusts the nominal

Q43: Exhibit 20-2<br>To benefit from the low correlation

Q44: A U.S. firm plans to borrow Swiss

Q45: MNCs can use short-term foreign financing to

Q46: Assume that the Swiss franc has an