Multiple Choice

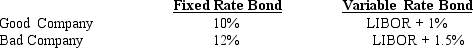

Good Company prefers variable to fixed rate debt. Bad Company prefers fixed to variable rate debt. Assume the following information for Good and Bad Companies:  Given this information:

Given this information:

A) an interest rate swap will probably not be advantageous to Good Company because it can issue both fixed and variable debt at more attractive rates than Bad Company.

B) an interest rate swap attractive to both parties could result if Good Company agreed to provide Bad Company with variable rate payments at LIBOR + 1% in exchange for fixed rate payments of 10.5%.

C) an interest rate swap attractive to both parties could result if Bad Company agreed to provide Good Company with variable rate payments at LIBOR + 1% in exchange for fixed rate payments of 10.5%.

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q4: If an MNC uses a long-term forward

Q14: An MNC issuing pound-denominated bonds may be

Q45: A callable swap gives the _ payer

Q45: Even if the interest rate associated with

Q46: When an MNC needs to finance a

Q46: A parallel loan represents simultaneous loans provided

Q47: If the foreign currency that was borrowed

Q49: In a(n) _ swap, the fixed rate

Q51: A _ gives its owner the right

Q53: The yields offered on newly issued bonds