The Following Regression Model Was Run by a U t

Where the Term on the Left-Hand Side Is the to Determine

Multiple Choice

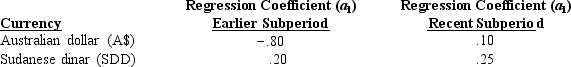

The following regression model was run by a U.S.-based MNC to determine its degree of economic exposure as it relates to the Australian dollar and Sudanese dinar (SDD) : PCFt = a0 + a1et + t

Where the term on the left-hand side is the percentage change in inflation-adjusted cash flows measured in the firm's home currency over period t, and et is the percentage change in the exchange rate of the currency over period t. The regression was run over two subperiods for each of the two currencies, with the following results: Based on these results, which of the following statements is probably not true?

Based on these results, which of the following statements is probably not true?

A) The MNC was more sensitive to movements in the Australian dollar than in the dinar in the earlier subperiod.

B) The MNC was more sensitive to movements in the dinar than in the Australian dollar in the more recent subperiod.

C) The MNC probably had more outflows than inflows in Australian dollars in the earlier subperiod.

D) The MNC probably had more inflows than outflows denominated in dinar in the more recent subperiod.

E) All of the above are true.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Jenco Co. imports raw materials from Japan,

Q21: According to the text, currency variability levels

Q23: Because creditors may prefer that firms maintain

Q24: _ exposure is the degree to which

Q26: Assume that the Japanese yen is expected

Q27: Diz Co. is a U.S.-based MNC with

Q28: One argument why exchange rate risk is

Q29: Translation exposure reflects:<br>A) the exposure of a

Q30: Assume that your firm is an importer

Q36: Which of the following is not true