Multiple Choice

The following regression model was estimated to forecast the value of the Indian rupee (INR) : INRt = a0 + a1INTt + a2INFt - 1 + t,

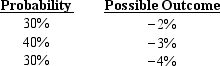

Where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the U.S. and India, and INF is the inflation rate differential between the U.S. and India in the previous period. Regression results indicate coefficients of a0 = .003; a1 = -.5; and a2 = .8. Assume that INFt - 1 = 2%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution: The expected change in the Indian rupee in period t is:

The expected change in the Indian rupee in period t is:

A) 3.40%.

B) 0.40%.

C) 3.10%.

D) 1.70%.

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Sensitivity analysis allows for all of the

Q49: Research indicates that currency forecasting services almost

Q57: Which of the following forecasting techniques would

Q58: Which of the following forecasting techniques would

Q59: Severus Co. has to pay 5 million

Q61: When the value from the prior period

Q63: Assume that U.S. interest rates are 6%,

Q64: Huge Corporation has just initiated a market-based

Q67: The following regression model was estimated

Q83: If the foreign exchange market is _