Multiple Choice

The following regression model was estimated to forecast the percentage change in the Australian Dollar (AUD) : AUDt = a0 + a1INTt + a2INFt - 1 + t,

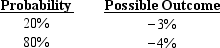

Where AUD is the quarterly change in the Australian Dollar, INT is the real interest rate differential in period t between the U.S. and Australia, and INF is the inflation rate differential between the U.S. and Australia in the previous period. Regression results indicate coefficients of a0 = .001; a1 = -.8; and a2 = .5. Assume that INFt - 1 = 4%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution: There is a 20% probability that the Australian dollar will change by ____, and an 80% probability it will change by ____.

There is a 20% probability that the Australian dollar will change by ____, and an 80% probability it will change by ____.

A) 4.5%; 6.1%;

B) 6.1%; 4.5%

C) 4.5%; 5.3%

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If the forward rate is used as

Q4: Which of the following is not a

Q14: Exchange rates one year in advance are

Q22: Which of the following is true?<br>A)Forecast errors

Q41: When measuring forecast performance of different currencies,

Q43: Assume that U.S. annual inflation equals 8%,

Q46: Sulsa Inc. uses fundamental forecasting. Using regression

Q50: A motivation for forecasting exchange rate volatility

Q64: Market-based forecasting is based on fundamental relationships

Q70: When a U.S.-based MNC wants to determine