Multiple Choice

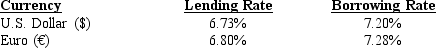

Assume the following information regarding U.S. and European annualized interest rates:  Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13. Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13. Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

A) $579,845.

B) $583,800.

C) $588,200.

D) $584,245.

E) $980,245.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: British investors frequently invest in the U.S.

Q5: Assume that the inflation rate becomes much

Q10: Forecasting a currency's future value is difficult,

Q10: Which of the following events would most

Q11: Country X frequently engages in trade flows

Q12: When expecting a foreign currency to depreciate,

Q12: Any event that reduces the U.S. demand

Q18: Relatively high Japanese inflation may result in

Q23: Illiquid currencies tend to exhibit _ volatile

Q44: When the Japanese yen appreciates against the