Multiple Choice

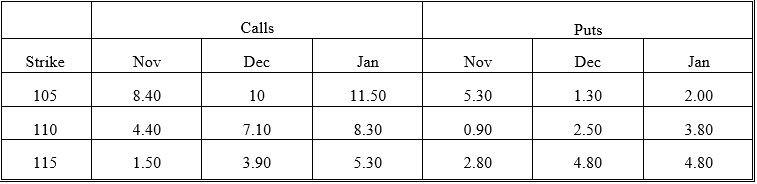

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the intrinsic value of the December 115 put?

A) 1.75

B) 0.00

C) 3.90

D) 3.00

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q46: The following quotes were observed for options

Q47: Holding everything else constant,call options are more

Q48: High volatility is bad for option holders

Q49: The difference between two American put options

Q50: Which of the following inequalities correctly states

Q52: The concept of the intrinsic value does

Q53: At expiration,the value of a European call

Q54: The following quotes were observed for options

Q55: Put-call parity is a relationship that can

Q56: The following quotes were observed for options