Multiple Choice

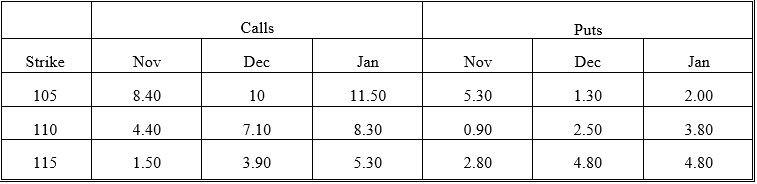

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-From American put-call parity,what are the minimum and maximum values that the sum of the stock price and December 110 put price can be?

A) 101.81 and 102.87

B) 2.50 and 113.25

C) 116.038 and 117.10

D) 7.125 and 110

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q26: The effect of volatility on a call/put's

Q27: The following quotes were observed for options

Q28: The spread between the prices of two

Q29: Transactions to exploit pricing errors in the

Q30: Which of the following statements about an

Q32: Holding everything else constant,put options are more

Q33: A situation in which early exercise of

Q34: The price of a call option is

Q35: The following quotes were observed for options

Q36: The difference between a Treasury bill's face