Essay

There has been much talk recently about the convergence of inflation rates between many of the OECD economies.You want to see if there is evidence of this closer to home by checking whether or not Canada's inflation rate and the United States' inflation rate are cointegrated.

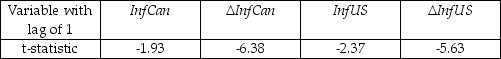

(a)You begin your numerical analysis by testing for a stochastic trend in the variables,using an Augmented Dickey-Fuller test.The t-statistic for the coefficient of interest is as follows:

where InfCan is the Canadian inflation rate,and InfUS is the United States inflation rate.The estimated equation included an intercept.For each case make a decision about the stationarity of the variables based on the critical value of the Augmented Dickey-Fuller test statistic.

where InfCan is the Canadian inflation rate,and InfUS is the United States inflation rate.The estimated equation included an intercept.For each case make a decision about the stationarity of the variables based on the critical value of the Augmented Dickey-Fuller test statistic.

(b)Your test for cointegration results in a EG-ADF statistic of (-7.34).Can you reject the null hypothesis of a unit root for the residuals from the cointegrating regression?

(c)Using a working hypothesis that the two inflation rates are cointegrated,you want to test whether or not the slope coefficient equals one.To do so you estimate the cointegrating equation using the DOLS estimator with HAC standard errors.The coefficient on the U.S.inflation rate has a value of 0.45 with a standard error of 0.13.Can you reject the null hypothesis that the slope equals unity?

(d)Even if you could not reject the null hypothesis of a unit slope,would that have been sufficient evidence to establish convergence?

Correct Answer:

Verified

(a)The critical value for the ADF is (-2...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A VAR with five variables, 4 lags

Q8: The coefficients of the VAR are estimated

Q13: A VAR with k time series variables

Q21: A vector autoregression<br>A)is the ADL model with

Q41: You have collected quarterly data on inflation

Q42: Multiperiod forecasting with multiple predictors<br>A)is the same

Q45: You have re-estimated the two variable VAR

Q47: The BIC for the VAR is<br>A)BIC(p)= ln[det

Q49: The lag length in a VAR using

Q50: Purchasing power parity (PPP),postulates that the exchange