Multiple Choice

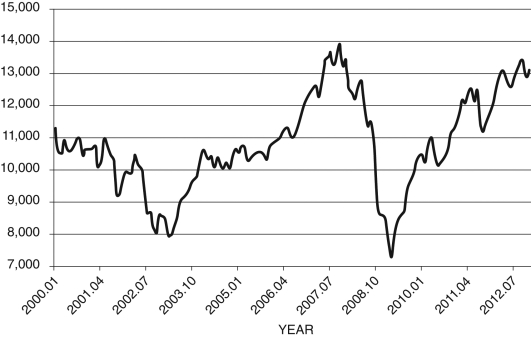

Refer to the following figure when answering the following questions.

Figure 17.2: Dow Jones Industrial Average: 2000-2012  (Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

-Your grandmother is a follower of the financial press and decides to quiz you about your knowledge of financial markets. She asks you to explain the price of stock prices based on the financial capital arbitrage equation. She shows you the graph shown in Figure 17.2. She asks you to explain the cause in the rise of stock prices for the years 2008-2012. What do you tell her?

A) "The graph suggests there are capital losses in financial markets, so to cover these losses, stock prices have to rise."

B) "Grandma, I was an art major and didn't have to take finance or economics classes."

C) "Ironically, falling capital gains have no impact on stock prices."

D) "A falling DJI leads to negative capital gains in financial assets. This, in turn, drives stock prices down."

E) "Because, in equilibrium, the real interest rate, capital gains, and dividends move in tandem, the decline in stock prices is due to 'irrational exuberance.'"

Correct Answer:

Verified

Correct Answer:

Verified

Q88: In the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6622/.jpg" alt="In the

Q89: The smallest component of physical investment is:<br>A)

Q90: The investment share of GDP has a

Q91: Between 2006 and 2010, the component of

Q92: Nonresidential fixed investment, residential fixed investment, and

Q94: In the simple model of financial asset

Q95: An increase in a firm's capital gains

Q96: Calculate Tobin's q for a firm. You

Q97: The investment-GDP ratio will rise if:<br>A) depreciation

Q98: The important tool introduced in Chapter 17