Essay

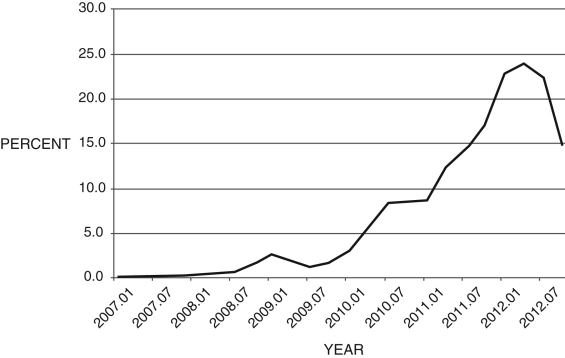

Figure 15.7 shows the difference between Greek and German 10-year bond yields from 2007-2013. Answer the following questions:

(a) What does this data represent?

(b) In the Smets-Wouters DSGE model, what type of shock is this?

(c) How does this shock affect the macroeconomy in the Smets-Wouters DSGE model? Explain.Figure 15.7: 10-Year Bond Yields: Greece minus Germany

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

Correct Answer:

Verified

(a) The difference between the Greek and...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: What makes DSGE models difficult to solve

Q33: The three components of any DSGE model

Q34: When taxes are included in the stylized

Q35: A computer virus that temporarily shuts down

Q36: Refer to the following figure when answering

Q38: In the Smets-Wouters DSGE model, a positive

Q39: Refer to the following figure when answering

Q40: In the labor supply curve, the parameter

Q41: A computer virus that temporarily shuts down

Q42: An important element of almost every DSGE