Multiple Choice

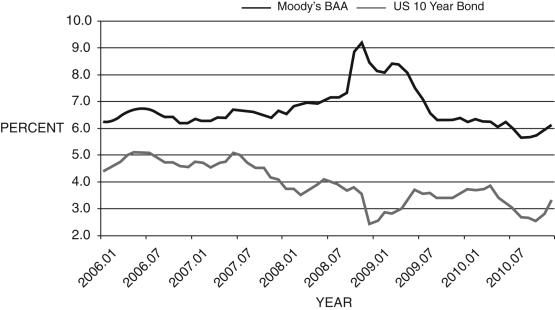

Figure 14.1: BAA and 10-Year Bonds, 2006-2010

-Consider Figure 14.1. The difference between these two curves can be interpreted as:

A) the financial friction.

B) inflation expectations.

C) the risk-free rate.

D) a market imperfection.

E) the prime lending rate.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: The average P/E ratio over the past

Q32: When the economy is in the liquidity

Q33: The financial friction raises the borrowing rate

Q34: When an economy is in a deflationary

Q35: The Monetary History of the United States,

Q37: The following statement is from the October

Q38: The Troubled Asset Relief Program was originally

Q39: Adding a financial friction to the short-run

Q40: In the aftermath of the recent financial

Q41: The liquidity trap occurs when:<br>A) real interest