Multiple Choice

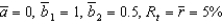

Consider two economies with the following IS curves, denoted 1 and 2:

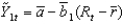

IS1:

IS2:

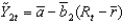

Given these two curves, the economies are identical except that they respond to interest rate changes differently. Suppose we assume

) If the real interest rate in each economy falls to

Then:

A) Country 1 will move from its long-run equilibrium to 1 percent above its potential and Country 2 will move from its long-run equilibrium to 0.5 percent above its potential.

B) Country 1 will move from its long-run equilibrium to 1 percent above its potential and Country 2 will move from its long-run equilibrium to -0.5 percent below its potential.

C) Country 1 will move from its long-run equilibrium to -1 percent below its potential and Country 2 will move from its long-run equilibrium to 0.5 percent above its potential.

D) Country 1 will move from 0.5 percent below its potential to its long-run equilibrium and Country 2 will move from its long-run equilibrium to 2 percent above its potential.

E) neither country will move away from its long-run equilibrium.

Correct Answer:

Verified

Correct Answer:

Verified

Q116: The IS curve describes short-run movements in

Q117: The I in the IS curve stands

Q118: Refer to the following table when answering

Q119: Defense spending in Afghanistan and Iraq is

Q120: The investment function is proportional to potential

Q122: What do economists generally believe is the

Q123: Government spending designed to mitigate short-run fluctuations

Q124: In the late 1990s, the United States

Q125: An increase in consumer expenditures during the

Q126: Refer to the following figure when answering