Essay

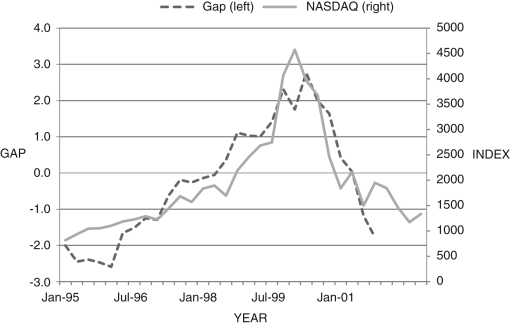

Consider Figure 11.8 below, which shows the output gap and the NASDAQ stock market index from 1995-2001. NASDAQ has a lot of "tech" firms that drove the rise in the stock market index in the late 1990s, as shown. As one can see, the output gap also rose to about 2.8 percent in April 2000. Explain this graph using the IS curve.Figure 11.8: Output Gap and NASDQ Index

Correct Answer:

Verified

This question can be answered two ways:

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: When there is a change to potential

Q35: A key assumption of Ricardian equivalence is:<br>A)

Q36: In the long run, the:<br>A) federal funds

Q37: In the long run, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6622/.jpg" alt="In

Q38: During a recession, increases in unemployment insurance,

Q40: The foundation of the IS curve is

Q41: Refer to the following figure when answering

Q42: U.S. government spending on goods and services:<br>A)

Q43: Suppose we assume that initially <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6622/.jpg"

Q44: One hypothesis for the lack of success