Essay

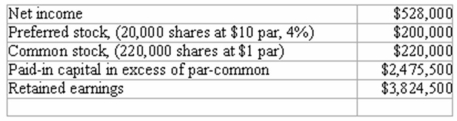

The following information was provided by Jongeward Company as of December 31, 2012:  On the most recent trading date, Jongeward's common shares sold at $36 and the preferred shares sold at $14.

On the most recent trading date, Jongeward's common shares sold at $36 and the preferred shares sold at $14.

The following information on industry averages is provided:

Earnings per share $3.06

Price-earnings ratio 19.2:1

Required:

1) Calculate and compare Jongeward Company's ratios with the industry averages shown above.

2) Discuss whether you would invest in this company.

Correct Answer:

Verified

1) Earnings per share = ($528,000 - $8,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Financial analysis typically involves some form of

Q30: The following balance sheet information is provided

Q31: All of the following are considered to

Q32: Solvency ratios are used to assess a

Q33: As of December 31, 2012, Grove Corporation

Q34: As of December 31, 2012, Grove Corporation

Q36: The Monticello Company reported net income of

Q37: Financial statement analysis involves forms of comparison

Q38: The return on investment measure is also

Q40: Select the incorrect statement regarding the quick