Essay

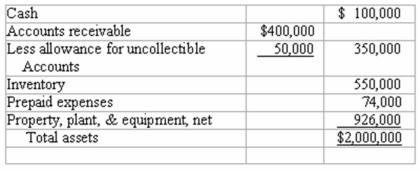

Leslie Company had a current ratio of 3:1 at the end of 2011. The asset section of the company's balance sheet is provided below:  Required:

Required:

1) Compute Leslie Company's end-of-year working capital.

2) Compute the company's quick (acid-test) ratio.

3) The company has a debt agreement with its bank that authorizes the bank to call in its loan to the company if the company's current ratio falls below 3:1 as of the last day of any month during the term of the loan. During January 2012, the company engaged in the three following transactions:

(a) Collected $100,000 on account;

(b) Purchased inventory on account, $50,000

(c) Paid accounts payable, $60,000

Will the company be in default after completing these transactions? Justify your answer.

Correct Answer:

Verified

1) Current assets = $2,000,000 - $926,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Monte Company reported the following operating results

Q7: Roanoke Company collected $500 on account. What

Q8: Net income divided by sales is the

Q9: The following income statement was prepared by

Q10: Short-term creditors are usually most interested in

Q13: Which of the following statements about financial

Q14: As of December 31, 2012, Grove Corporation

Q16: Comparative income statements for Purcell Company are

Q78: Jones Company's current ratio is higher than

Q91: Describe the factors involved in communicating useful