Essay

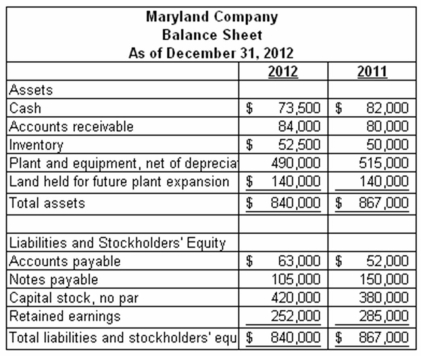

Maryland Company's balance sheet and income statement are provided below:

The company paid cash dividends of $2.00 per share during 2012. On December 31, 2012, the stock was listed on the stock exchange at a price of $75.25 per share.

The company paid cash dividends of $2.00 per share during 2012. On December 31, 2012, the stock was listed on the stock exchange at a price of $75.25 per share.

Required:

Compute the following ratios for 2012:

(a) Accounts receivable turnover

(b) Average days to collect receivables

(c) Inventory turnover

(d) Average days to sell inventory

(e) Debt to assets ratio

(f) Debt to equity ratio

(g) Net margin

(h) Asset turnover

(i) Return on investment

(j) Dividend yield

Correct Answer:

Verified

Correct Answer:

Verified

Q69: Select the incorrect statement regarding net margin.<br>A)Net

Q75: Vertical analysis involves comparing amounts in the

Q92: What is a primary drawback with examining

Q105: An analysis procedure that uses percentages to

Q106: Which type of approach should be used

Q107: As of December 31, 2012, Grove Corporation

Q109: Salem Company is seeking a short-term loan

Q109: Indicate whether each of the following statements

Q111: The Mount Vernon Company reported gross sales

Q114: The debt to equity ratio can be