Short Answer

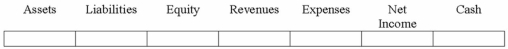

Kirk Co. sells goods to customers with a three-year warranty. During 2012, Kirk sold $500,000 of goods. On December 31, 2012, Kirk made the appropriate year-end adjustment to record the warranty expense related to the goods sold during the year. During 2013, Kirk paid $400 cash to satisfy warranty claims. Show the effects of the 2012 adjustment to record warranty expense.

Correct Answer:

Verified

(N) (I) (D) (N) (I) (D) (N)

Explanation:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: When is warranty expense usually recognized?

Q10: Issuing a note payable is a(n)<br>A)claims exchange

Q64: Fern's Flower Market sells eight potted petunias

Q65: When calculating interest expense on a 6-month

Q66: In September of 2013, Houston Company issued

Q69: Calvin Campbell is hired by Forest Associates

Q70: On October 1, 2012, Haywood Company borrowed

Q71: The amount of total liabilities that would

Q72: Hamm Co. borrowed $10,000 from Townsend Co.

Q108: Monthly remittance of sales tax due has