Short Answer

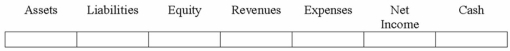

Kirk Co. sells goods to customers with a three-year warranty. During 2012, Kirk sold $500,000 of goods. On December 31, 2012, Kirk made the appropriate year-end adjustment to record the warranty expense related to the goods sold during the year. During 2013, Kirk paid $400 cash to satisfy warranty claims. Show the effects of the 2013 payments to satisfy warranty claims.

Correct Answer:

Verified

(D) (D) (N) (N) (N) (N) (D)

Explanation:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Indicate whether each of the following statements

Q12: Gilson Company pays Matt Sawyer a salary

Q13: What factor distinguishes an employee from an

Q14: At the beginning of 2013, MacKenzie, Inc.

Q15: Receivables are normally reported on the balance

Q17: After accruing all interest expense due as

Q20: How is the current ratio calculated, and

Q21: The amortization of the discount on a

Q26: Sales tax is reported as revenue when

Q91: The term used to describe the ability