Short Answer

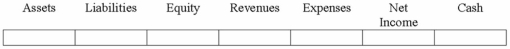

Chenowith Company recognized payroll tax expense for employer portion of FICA tax and federal and state unemployment taxes.

Correct Answer:

Verified

(N) (I) (D) (N) (I) (D) (N)

Explanation:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(N) (I) (D) (N) (I) (D) (N)

Explanation:...

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q75: If a company offers a warranty on

Q82: A classified balance sheet is necessary for

Q106: Vincent Company purchased $8,000 of equipment by

Q107: Which of the following accounts appear in

Q108: How does the going concern assumption affect

Q109: On October 1, 2012, Haywood Company borrowed

Q111: Which of the following items would be

Q112: The amount of interest expense appearing on

Q114: Use the information on January 1, 2013

Q115: Under what condition should a pending lawsuit