Short Answer

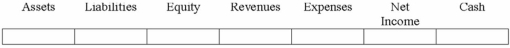

On December 31, 2013, Weston Co. recognized accrued interest expense in the amount of $1,000. The interest expense was related to a discount note Weston had issued earlier.

Correct Answer:

Verified

(N) (I) (D) (N) (I) (D) (N)

Explanation:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Issuing a note payable is a(n)<br>A)claims exchange

Q53: Employers must withhold unemployment taxes from employee

Q57: The December 31, 2013 balance sheet of

Q59: Which of the following represents the correct

Q60: Charles Co. repaid a note payable on

Q64: Fern's Flower Market sells eight potted petunias

Q65: When calculating interest expense on a 6-month

Q66: In September of 2013, Houston Company issued

Q77: The issuer of a note payable is

Q108: Monthly remittance of sales tax due has